| Pair | Topic |

Observation |

| 1 | Debt |

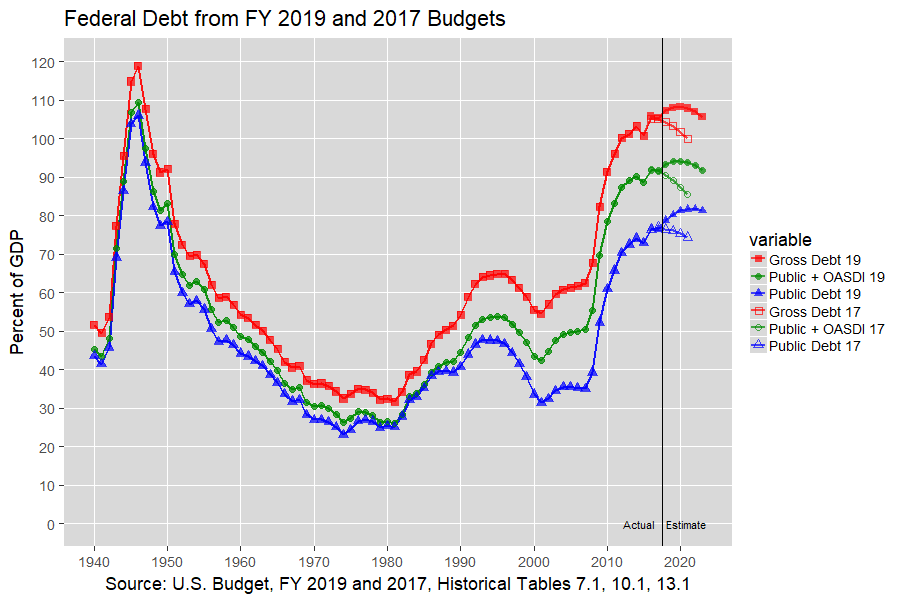

Obama's final budget (FY 2017) projected that the debt held by the public would drop slightly to 75.5 percent of GDP by 2021. This budget projects that it will increase to 81.7 percent of GDP by then. Similarly, this budget revises the projected level of the gross debt in 2021 from 101.4 percent of GDP to 107.9 percent of GDP. |

| 2 | Deficit |

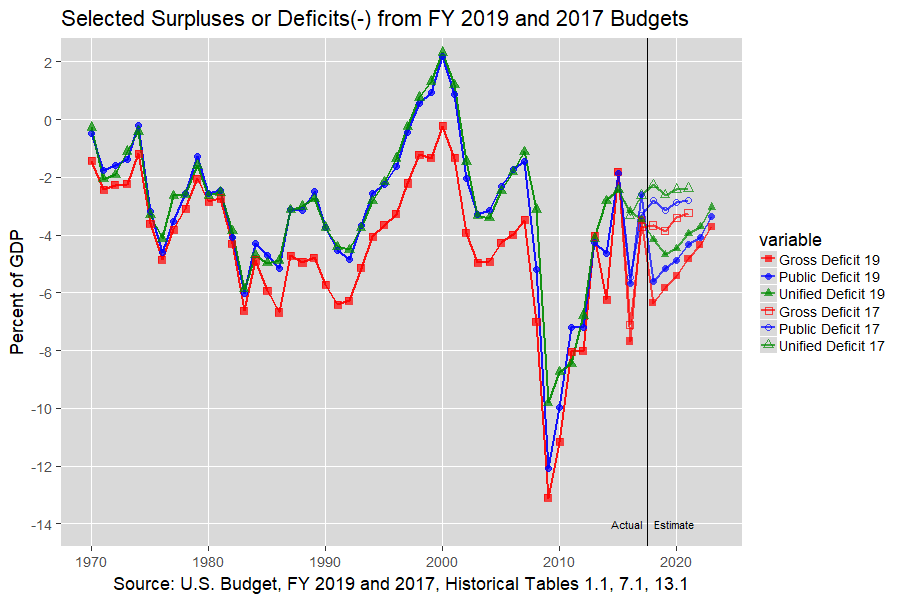

The last Obama budget projected that the unified deficit would drop slightly from 2.6 percent of GDP in 2017 to 2.4 percent of GDP in 2021. This budget projects that it will vary between 3.5 and 4.7 percent of GDP during that period. |

| 3 | Receipts |

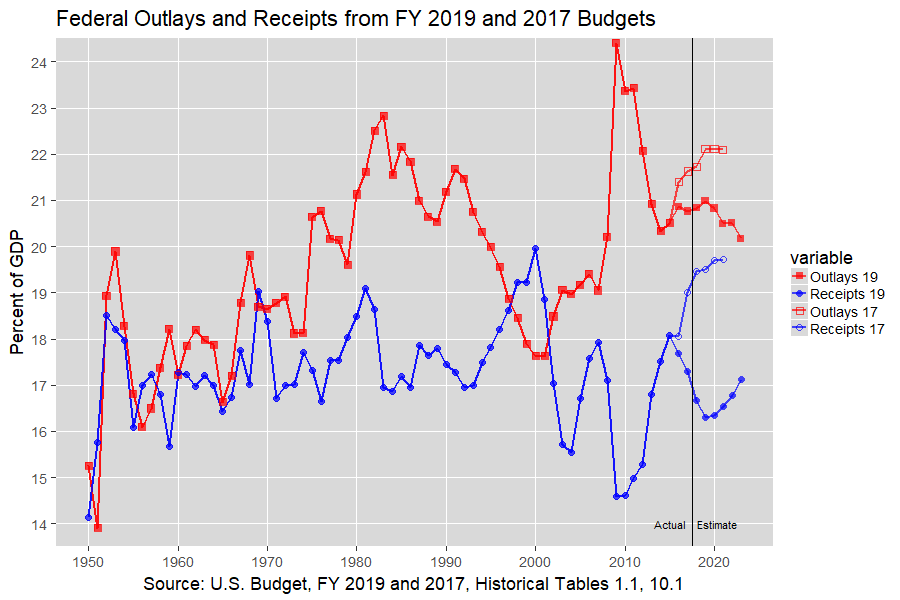

The last Obama budget projected that receipts would rise to 20 percent of GDP by 2021 whereas this budget projects that receipts will drop to 16.5 of GDP by then. Similarly, the last Obama budget projected that outlays would rise to about 22.4 percent of GDP by 2021 whereas this budget projects that outlays will drop slightly to 20.5 percent of GDP. |

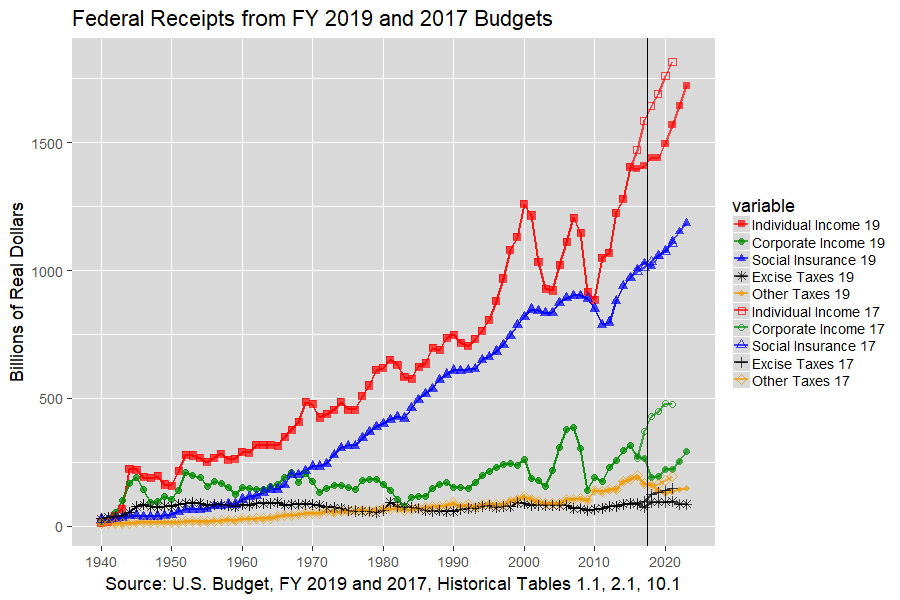

| 4 | Receipts |

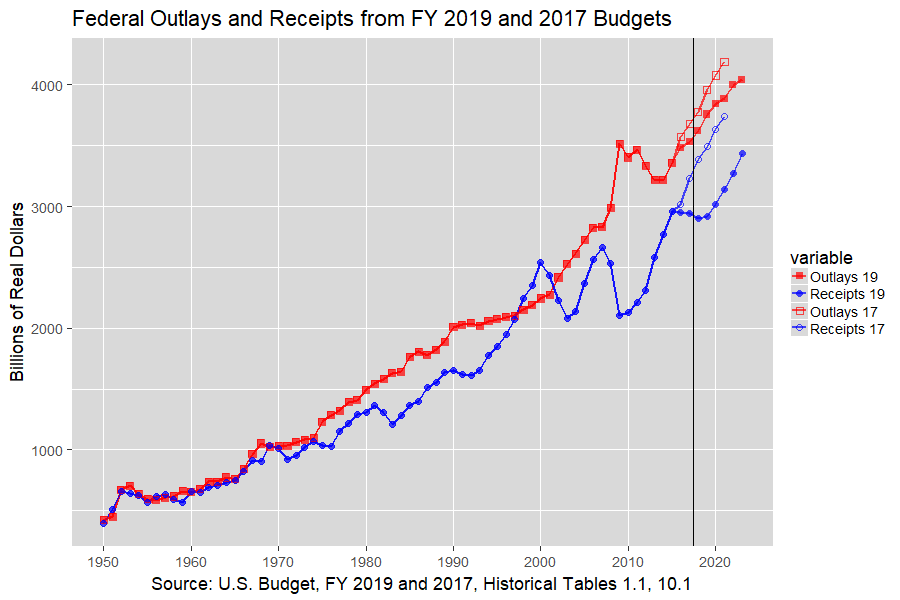

The last Obama budget projected steady growth in real receipts from 2017 to 2021 whereas this budget projects that real receipts will stagnate through 2019 before resuming growth. Both budgets projected steady growth in real outlays though the last Obama budget projected slightly higher growth. |

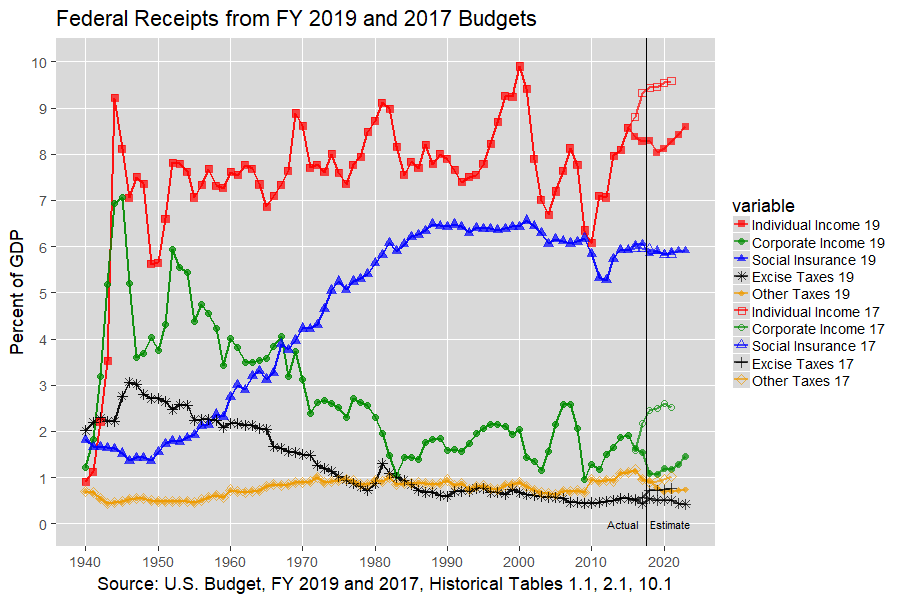

| 5‑6 | Receipts |

The last Obama budget projected that individual tax receipts would grow from 9.3 to 9.7 percent of GDP from 2017 to 2021. This budget projects that they will vary from 8.0 to 8.3 percent of GDP during that period. Similarly, the last Obama budget projected that corporate tax receipts would grow from 2.2 to 2.5 percent of GDP during that period but this budget projects that they will drop from 1.5 percent of GDP in 2017 to 1.1 percent of GDP and recover slightly to 1.2 percent of GDP by 2021. This decline in individual and corporate tax receipts is likely due to the Tax Cuts and Jobs Act of 2017. |

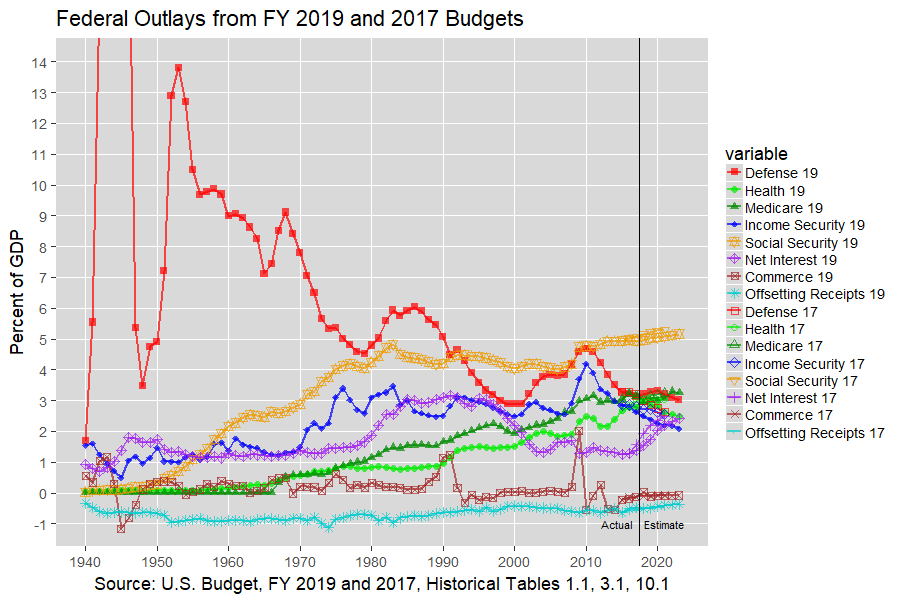

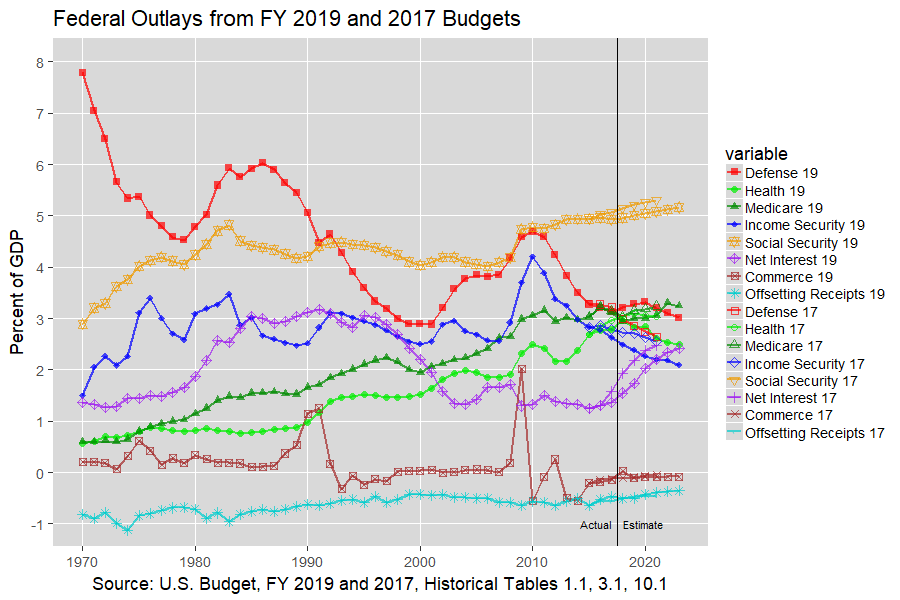

| 7‑8 | Outlays |

Projections for Defense spending in 2021 is significantly higher in this budget than the last Obama budget and spending in Health (which is chiefly Medicaid), Income Security, and Net Interest is significantly lower as a percent of GDP. Projected spending for Medicare and Social Security is slightly lower in this budget than in th last Obama budget. |

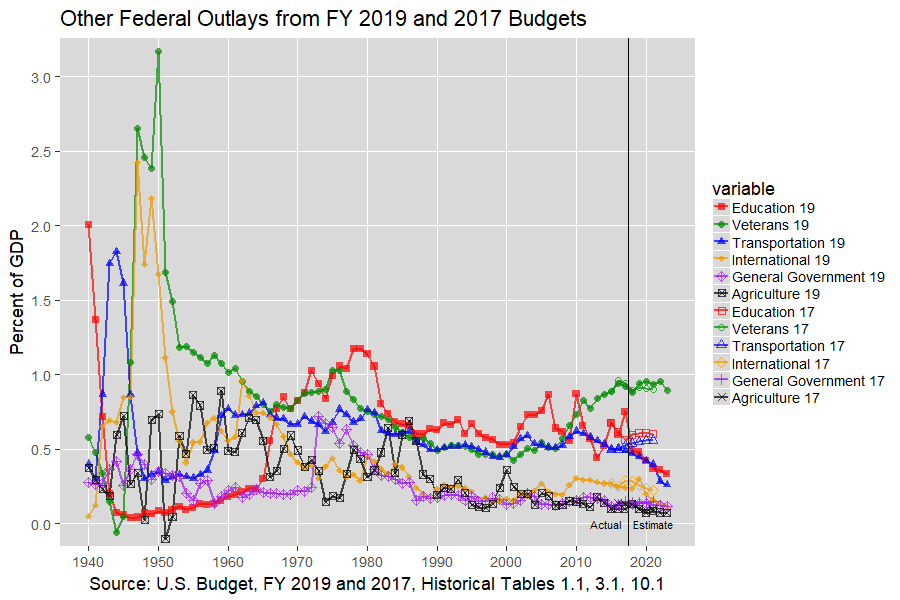

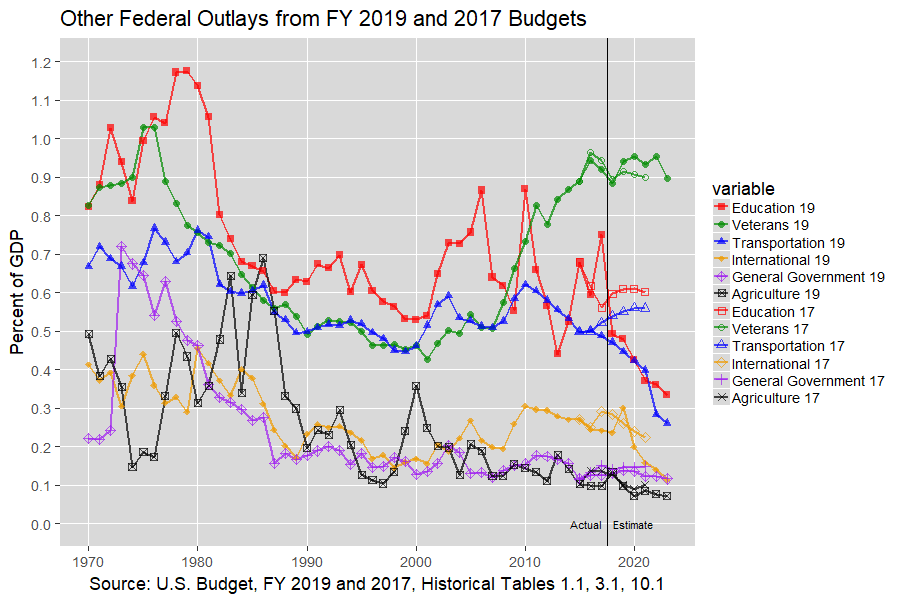

| 9‑10 | Outlays |

Projections for Education, Transporation, and International spending in 2021 is significantly lower in this budget than in the last Obama budget. Projections for General Government and Agriculture spending is slightly lower in this budget and Veterans spending is slightly higher in this budget than the last Obama budget. |

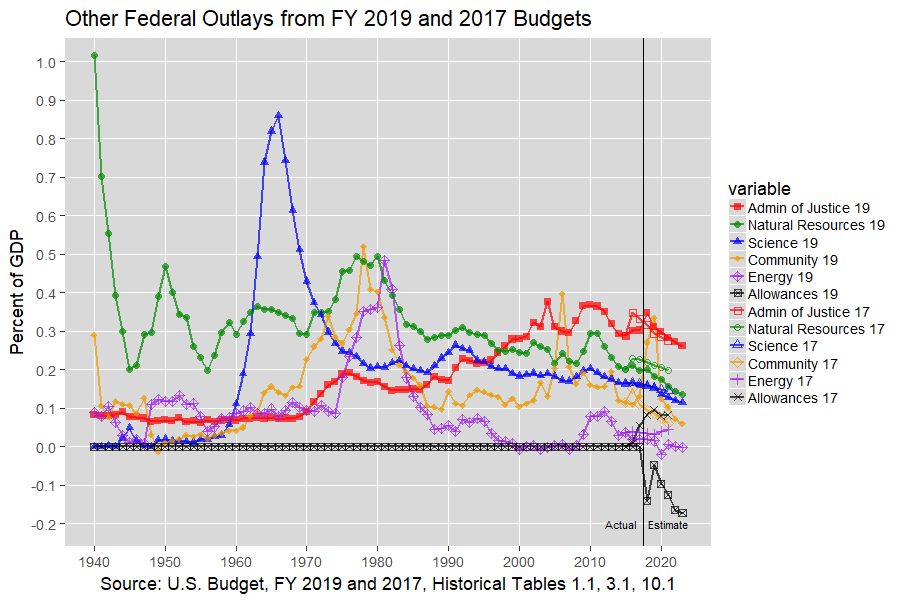

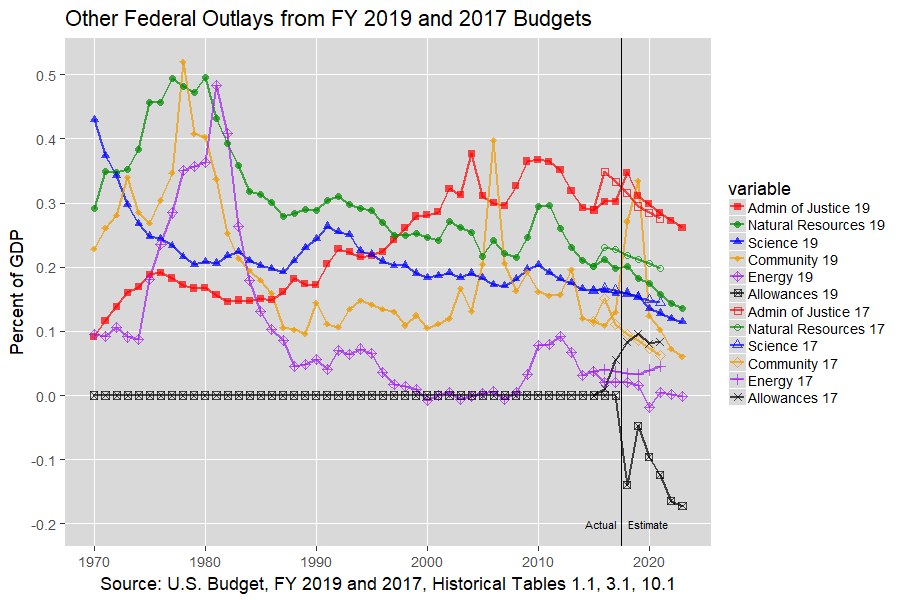

| 11‑12 | Outlays |

In this budget, the one discernible change in projected outlays for Administration of Justice, Natural Resources, Science, Energy, Allowances, and Community and Regional Development is the last function. Historical Table 3.2 shows that it increases from about $25 billion in 2017 to $54 billion in 2018 and $70 billion in 2019 before returning to $27 billion in 2020. The increase in 2018 is chiefly in the subfunction of "Disaster relief and insurance" and the increase in 2019 is chiefly in the subfunction of "Area and regional development". Much of this last amount might be for infrastructure but it's not clear from that table. The other main change in these outlays is in Allowances from 0.085% of GDP in 2021 in Obama's last budget to -0.124% of GDP in 2021 in this budget. |

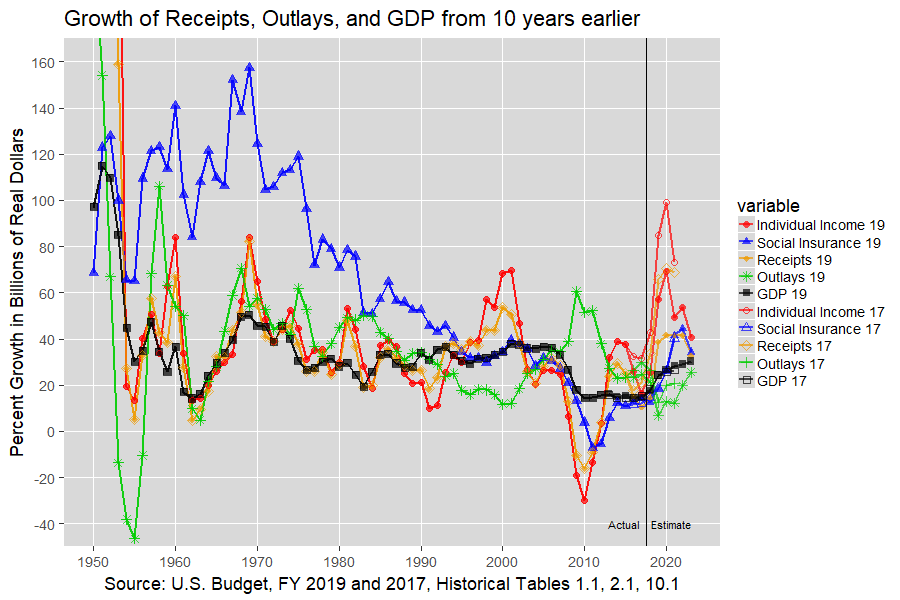

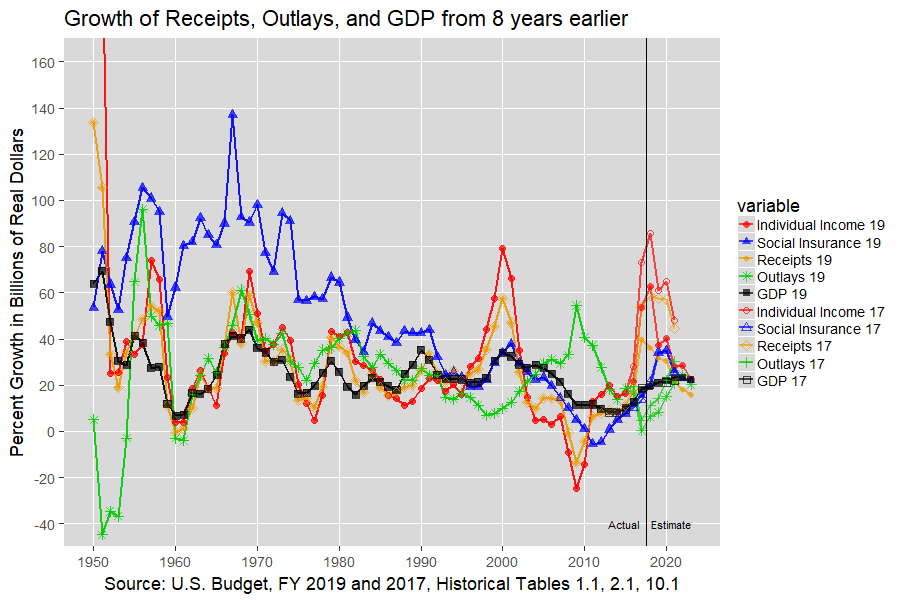

| 13‑14 | Growth |

In the last Obama budget, individual income tax receipts were projected to grow about 70 percent in the 10 years ending in 2021 and about 45 percent in the 8 years ending in 2021. In this budget, those growth rates drop to 49.4 and 28 percent, respectively. This drop in individual and corporate tax receipts is likely due to the Tax Cuts and Jobs Act of 2017. |